Cautious optimism for Q3 and Q4

Market analysis

The UK capital markets continue to struggle after the macroeconomic landscape caused investor appetite to plummet in 2022. Over the six months to June 2023, interest rate hikes persisted and inflation showed only marginal movements back to the levels seen between 2015 and 2021. Owing largely to political uncertainty in the UK and the ongoing conflict in Ukraine these factors, among others, have maintained a lack of confidence across the London markets. Notwithstanding this, the quantity of UK-based new issues in 2023 Q2 climbed to 17, more than the previous two quarters combined. This suggests that improvements may be just around the corner.

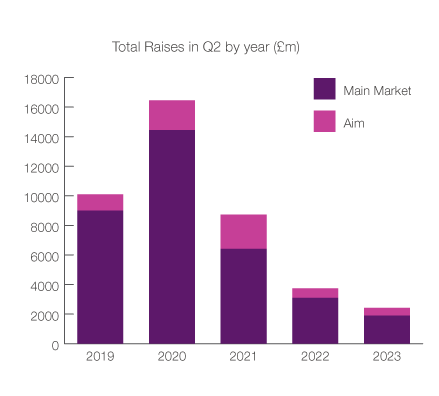

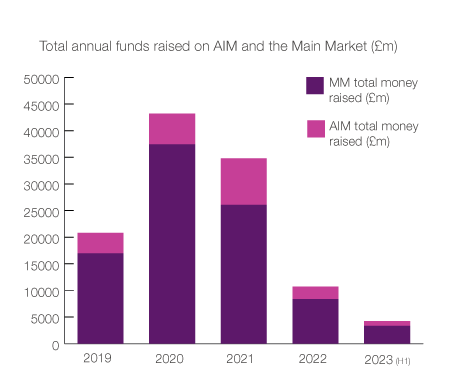

In the second quarter of 2023, total amounts raised were down again on the previous year. Q2 saw five-year lows in both AIM and the Main Market of £1.9bn and £0.5bn respectively. This is a reduction of 35% on the same period in 2022, and 85% going back to 2020.

Looking back over the first half of 2023, total funds raised also tracked at a lower rate than the previous year, and the majority of raises were comprised of further issues, rather than new entrants to the markets. These trends highlight the current stagnant nature of capital markets in the UK.

Whilst down on the same quarter in 2022 in terms of total money raised, the number of new issues climbed over the last period, as we’ve said, with a total of 17 in the UK. Of these new issues, 12 joined the Main Market and five joined AIM.

Recent transactions

Acting as reporting accountants on six transactions across both markets, PKF is pleased to have been involved in the listing of World Chess Plc, Altona Rare Earths Plc and Kanabo Group Plc on the Main Market and Fox Marble Holdings Plc, Drumz Plc and Golden Metal Resources Plc on AIM.

World Chess Plc debuted on the Main Market in April with an approximate market capitalisation on admission of £41.7m, raising gross proceeds of £3.04m. World Chess Plc is a leading organisation in the chess industry, looking to capture public interest and generate wider market appeal through new formats and tournaments.

In the manufacturing sector, Fox Marble Holdings Plc successfully completed the reverse takeover acquisition of Eco Buildings Group Limited in May. Raising gross proceeds of £2.7m, the renamed Eco Buildings Group Plc aims to provide a range of environmentally friendly, prefabricated modular housing products in Albania and Kosovo.

Amid high global political tensions and economic uncertainty, the UK IPO market has struggled to recover from the turmoil in 2022 and the risk of recession persisted into the summer months of 2023.

Looking ahead

Despite this, the many factors which provide the foundations for the UK’s macroeconomic landscape are still largely unknown, and the latest increase in new issue numbers is a hint of light at the end of the tunnel. Recent declines in inflation rates also deliver some hope for increased IPO activity, giving a somewhat positive outlook for the rest of the year.

Preparations continue for a boost in the number of prospective issuers looking to capitalise on potential investors in the post-summer holiday period. This means expectations for a productive final two quarters are high, with aspirations for a strong rebound in the UK capital markets.