Broking Business – Winter 2021

Now’s the time to make sure your contractors aren’t avoiding tax.

The Government’s approach to combatting corruption, money laundering and tax evasion was enhanced when the Criminal Finance Act 2017 introduced two Corporate Criminal Offences (CCOs). The first, where companies fail to prevent the facilitation of tax evasion in the UK, and the second where the failure to prevent tax evasion is in a foreign country.

The offences apply to all entities, regardless of size, and carry the risk of criminal prosecution and unlimited fines. Companies operating in regulated industries will also suffer from additional regulatory scrutiny and reputational damage.

For insurance brokers and intermediaries, this means that where an act of criminal tax evasion takes place under UK law (please note that a conviction is not required) and an associated person of the broker facilitates the tax evasion, while performing services for or on behalf of the broker, the broker will be guilty unless it can prove the statutory defence.

HMRC defines associated persons as employees, agents or any other person who performs services for and on behalf of the broker and can be either an individual or incorporated body.

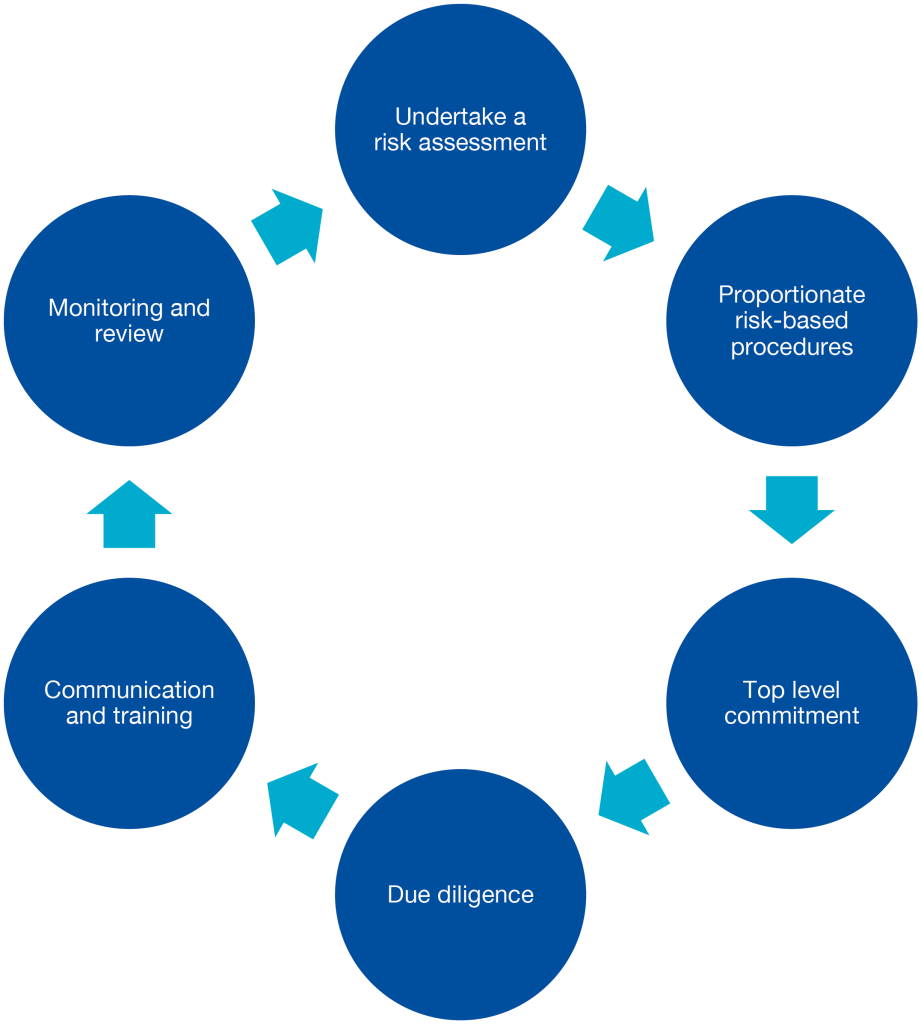

HMRC’s guidance to the statutory defence covers six principles:

The guidance states clearly that any risk assessment carried out must be focused on tax and be specific to the company’s business. The larger the group, the size of its global footprint and the range of associated persons increases the potential exposure. Brokers rebadging anti-money laundering (AML) and ‘know your customer’ (KYC) procedures won’t have a statutory defence unless all the tax risks are considered and evaluated.

In light of the above it’s worth considering the impact of HMRC’s recent reminder in October’s Employer Bulletin about temporary workers and the use of umbrella employment companies.

Recruitment agencies may outsource their HR and payroll to an umbrella company which employs the temporary workers. Many umbrella companies are compliant with the tax requirements however, there are a number which are operating tax avoidance ‘disguised remuneration schemes’.

These schemes try to avoid the need to deduct Income Tax and National Insurance contributions which would usually be due under PAYE. Through using mini-umbrella companies others have operated payroll fraud or company fraud.

HMRC’s guidance reinforces a company’s responsibility to understand how their workers are engaged and paid. If their workers are employed through an umbrella company, both the company and its workers are left vulnerable to lengthy tax compliance checks, tax liabilities and penalties as well as considerable reputational damage.

This isn’t just a payroll and employment matter but also a CCO one too. Failure to review the risk, and take the necessary steps to reduce the risk, may well leave the company unable to claim the benefit of the statutory defence when challenged by HMRC.

This is just another example of how critical the risk review and proportionate risk-based procedures under the CCO process are to ensuring a defensible position in the fight against facilitating tax evasion.