Viewpoint

Spotlight - Deals in focus

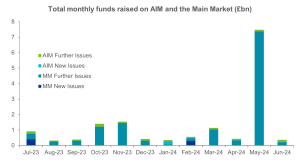

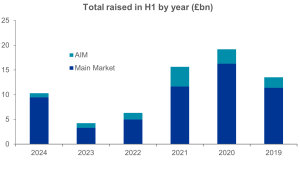

There is tempered optimism that the ice is beginning to thaw on UK Capital Markets and a hope, more than an expectation, of a return to the halcyon days of 2021 and 2020. The first half of 2024 saw a combined total of £10.31bn raised across the Main Market and AIM, representing an increase of 143% and 63% on the same period in 2023 and 2022 respectively. This total is skewed by a single secondary raise from the National Grid Plc of £7bn in May 2024. Excluding this secondary raise, total funds of £3.31bn were raised, relative to £4.24bn and £6.32bn in 2023 and 2022 respectively.

The market for secondary raises was the most active with £9.73bn raised, equating to 94% of total funds raised. There was a total of 18 new issues to AIM (10) and the Main Market (8) in H1 2024, of which PKF acted as reporting accountant on one third (6) of these transactions. We were especially proud to have been involved in half (5) of the new issues on AIM in the period, including the likes of Helix Exploration Plc and European Green Transition plc. Helix Exploration Plc debuted on AIM in an oversubscribed IPO, raising £7.5m to explore and develop a helium resource in Montana, USA. The area shows promising signs of a rich, non-hydrocarbon, helium gas deposit. The share price has climbed approximately 134% since IPO. European Green Transition plc also admitted to AIM in H1 2024, raising a total of £6.45m. Their vision is to build a portfolio of high quality green economy assets – including, solar and wind farms, rehabilitation and processing projects, and more – through an M&A focused-model. They have already acquired a high quality portfolio of assets, notably its principle Olserum Rare Earth Element (REE) project in Sweden. For more information on EGT, read our interview with Aiden Lavelle, CEO and Jack Kelly, CFO.

Much akin to the British summer, the UK IPO market has shown momentary flashes of the sunny days of 2021 and 2020. There are several reasons to believe (hope) the market conditions will improve. Inflation has been wrestled down to 2% from its peak of 11% in October 2022 and we should see the central bank loosen its monetary belt as we enter autumn. Interest rates are soon expected to be cut for the first time since March 2020 and they could reach 3.5% by the end of 2025, weakening the squeeze on the real economy and creating better conditions for IPO activity. Political uncertainty has eased since Rishi Sunak announced the General Election in May. There is hope this new Labour government, if Keir Starmer’s rhetoric is to be believed, will usher in economic growth and investment. We would settle for stability. This is all set against the backdrop of a backlogged IPO pipeline and the FCA’s new listing rules enacted on 29 July 2024, the largest overhaul of listing rules in three decades. The aim is to make the LSE more attractive, enabling it to better compete against other international exchanges. These factors make us tentatively sanguine for the second half of the year. We will be packing a raincoat and the SPF.

The M&A and private space has proved equally difficult. 2023 closed with aspirations of a resurgence in the deal market but we have observed much of the same patterns. There was a small increase in the total value of UK M&A activity but a decrease in total deal volumes due to the macroeconomic landscape, particularly interest rates and inflation. However, at the lower end of the market deals are still progressing and the grass is looking greener for the rest of 2024 and the conditions for dealmaking are improving.

We have also seen the theme of take-private deals in the UK, which became increasingly popular in 2023, continuing into the first half of 2024. The increasing regulatory burden on small listed companies and limited liquidity have made public markets less attractive, prompting many firms to consider private investors. Additionally, suppressed valuations and the availability of private credit financing have created favourable conditions for private equity firms to pursue these deals. The flexibility to implement long-term strategies without the pressure of quarterly earnings reports is another appealing aspect for management teams. As a result, take-private transactions are playing a prominent role in the UK M&A landscape in 2023 and 2024.

For further information or guidance, please contact Jack Devlin.